TechXplorer Issue 28 Covers Rocsole’s Success

Shell’s TechXplorer publication covers Rocsole’s success story in it’s latest issue no. 28. With permission from Shell, we’re publishing that piece.

The first time a cinema audience heard an amplified film soundtrack was when Eric Tigerstedt, the “Thomas Edison of Finland”, demonstrated his patented “photomagnetophone” in 1914. The device was never commercialised, however; the inventor ran out of money and lacked good business advice. Finnish company Rocsole has not made the same mistake. It has secured the support of Shell Ventures, thereby receiving not only seed capital but also inspiration for new pipeline-inspection devices and insights into the oil and gas business.

When Rocsole was formed in 2012, the company comprised a handful of technically driven research and development engineers, scientists and mathematicians. The cofounders were all from the University of Eastern Finland. Jari Kaipio and Marko Vauhkonen were professors in the department of applied physics, and Anssi Lehikoinen and Pasi Laakkonen held PhDs; Pasi had also been the research director of the physics department. Their strengths were in the processing of digital data and their focus was on the commercialisation of related technology.

The services they planned to bring to market relied on sophisticated digital signal processing to turn electrical capacitance measurements made inside a pipe or tank into real-time tomographic images of fluids and solids in a cross section of the equipment being monitored. Initially, they positioned the start-up as an industrial-process-monitoring company and planned to promote their tomography services in the mining sector.

As work progressed on imaging the inside of pipelines, it became clear that the oil and gas sector was a natural and potentially lucrative market for their technologies. In September 2015, Anssi and Pasi visited Amsterdam to pitch for Shell’s business.

The potential of the Rocsole system as an alternative to pipeline pigging and other

inspection techniques was clear to those at the demonstration. The laboratory-scale, proof-ofconcept set-up they saw was able to identify wax, scale and asphaltene deposits inside a pipe spool in real time without needing the potentially hazardous radioactive sources found in competing systems. In practice, however, the technology was far from ready for deployment in oil and gas processes.

Peter van Giessel, who looks after Shell Ventures’ oil and gas portfolio, sums up his initial thoughts on the company: “When we met Rocsole, its products looked useful but were not mature or reliable.” But that was not all; it seemed to Shell that Rocsole did not really understand the oil and gas business. “A big hurdle was that the pipe had to be cut to install the deposit sensor. We knew that few asset managers would have an appetite to do this unless it coincided with maintenance activities, which meant the potential market was rather small.”

Small wonder

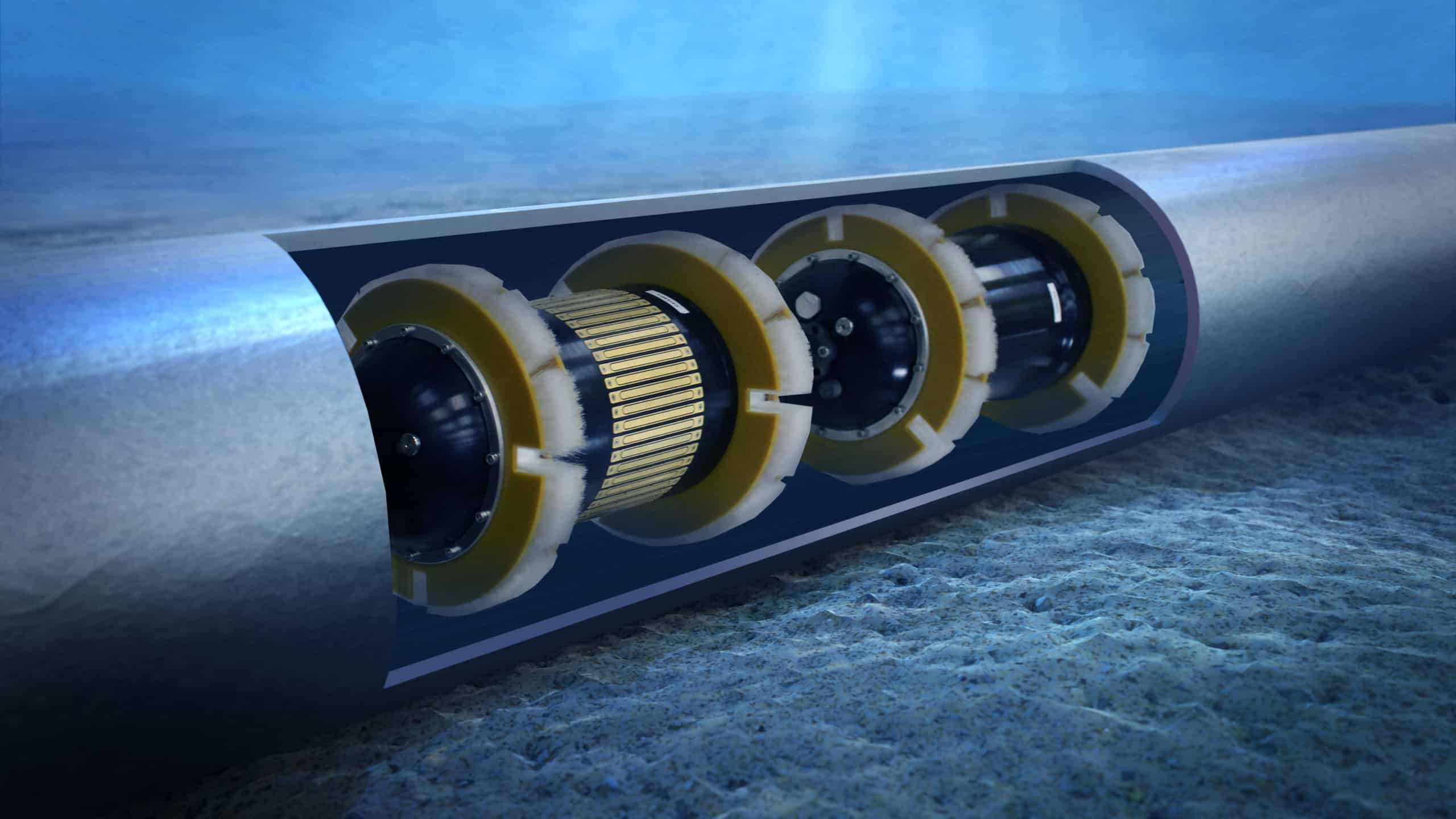

Although the demonstration failed to generate much immediate interest, it did spark an idea to modify the way in which the technology was deployed. Loek Vreenegoor, then general manager of Shell’s pipelines, flow assurance and subsea engineering group, saw the potential for mounting Rocsole’s sensors on a pipeline pig. This would enable the inside-out imaging of deposits along the entire length of a pipeline. Supported by Loek, Rocsole started to develop a prototype in-line inspection tool while also working on its static sensors for oil and gas applications.

Aware that it might be seeing the birth of a new, capacitance-based pipeline inspection tool, Shell Ventures continued to follow the company’s progress with interest. Peter remembers that several months of downtime and very high costs had once resulted from an inspection pig becoming stuck in a North Sea pipeline. “We got excited by the work being done at Rocsole, because its sensors could work with a relatively large standoff from the pipe wall. There was the possibility that a Rocsole pig could be smaller than conventional pigs, and this would make it less likely to become stuck.”

When Rocsole started looking for equity backing in 2015, it approached a range of potential partners that included equipment manufacturers, chemical and oil companies, and technology venture capitalists. Among them it hoped to find candidates that were open to new ideas, innovators and early adopters. “The oil and gas industry is conservative when it comes to adopting innovative technologies, so we needed help building credibility and understanding,” says Mika Tienhaara, previously a member of the board of directors and now the chief executive officer. “Partnering with Shell was a good fit for us at that phase of the company’s development, so, when it came to selecting backers, we put Shell Ventures near the top of our list.”

Figure 1: Rocsole adapted its processing techniques for creating tomographic images of pipe cross sections to work with data coming from sensors mounted on a pipeline pig.

Buying in

Shell Ventures took a minority equity stake in Rocsole in 2017, just as the in-line inspection tool was moving from a proof of concept into the development phase. Positive results from a probe sensor installation at a Finnish tank farm in 2016 also contributed to growing confidence within the company that it had a viable way of addressing customers’ problems. However, as time passed, investors wanted to see the company’s products brought to market more quickly and at a lower cost.

Mika attributes the slower than anticipated commercialisation of Rocsole’s growing portfolio of ideas to the backgrounds of his team’s members. “Our guys are terrific, but they were used to doing research and development, they felt comfortable with that.” He candidly describes the unfamiliar landscape that the company now found itself in and the challenges that came with it. “It is quite common for start-up companies to get stuck in the proof-of-concept or piloting stage and fail to scale up commercially. We did not want to do that. We were conscious that we needed to move beyond trying to prove that our technology could work to ensuring that it did work and showing how it could bring value to customers.”

As the priorities and requirements of the oil and gas industry became clearer from discussions with potential customers and investors, Shell Ventures was able to offer Rocsole valuable input (see boxed text, Board talk). For example, it emphasised the urgent need for the company’s products to be certified to IECEx standards for use in explosive atmospheres. As Mika recalls, “Shell challenged us in a positive way. To be honest, they gave us the push that we needed.”

The results were encouraging. The increased interest from Shell in Rocsole’s tank and separator monitoring technologies is attributed to the company gaining IECEx certification for its sensors. Shell now believes that these services offer potential savings on maintenance activities, as well as being relatively cheap compared with the alternatives. This view vindicates Rocsole’s underlying proposition, which is that it offers insights that help operators to cut their operating costs and improve production.

Rocsole now differentiates its services from other investigation services in the way it applies its expertise in data acquisition and analytics. Instead of applying algorithms to interpret occasional snapshots from sensors installed for other purposes, Rocsole’s technology captures proprietary electrical data many times per second. This enables it to provide insights into flow regimes with accreting solids – environments in which conventional sensors would be rendered inoperable by fouling or the buildup of deposits.

Growing together

Peter is complimentary about the progress that Rocsole has made since Shell Ventures took an equity interest. At the outset, it recognised that it was investing in a small, highly driven company, one that was endeavouring to follow up too many leads at once. “As a start-up, it was natural that Rocsole was trying to offer exactly what every potential customer wanted,” recalls Peter “but this was placing heavy demands on the company and often opportunities were not being realised.”

One of Shell Ventures’ roles was to infuse some realism. “We had to push the company quite hard to change,” says Peter. “We wanted to see a more focused sales force with a change in the incentive structure to drive sales. But we had to strike the right balance and not stifle the entrepreneurial spirit.”

Mika is also realistic about the time it took to build a trusting relationship, given the different cultures of Rocsole and Shell. “Of course, there have been challenges every now and then,” he says, with good humour. He puts some of this down to cultural differences, noting that Finns are not the

most naturally outgoing people. “It took time to get to know each other,” he continues, “but now everybody realises that open communication is the way to make the best of the relationship.”

The company’s willingness to outsource the development of explosion-proof equipment, which had been on the agenda for around 18 months, is representative of the sort of changes that came about. “I think working with Shell has been a very good way of moving our company forward by future-proofing what we are doing,” says Mika. Commenting that the relationship has provided a relatively forgiving environment to test ideas, he notes, “I would rather have Shell give us its candid views, whatever they are, before going out to other companies!”

The value of Rocsole’s innovations appears to have been recognised in the marketplace. In 2019, it gained 15 new clients representing a fourfold increase on the total at the beginning of that year and reported a year-on-year increase in revenues from €152,000 ($170,000) to €808,000 ($905,000). Oil and gas sector customers now include operators Equinor, Neste, Repsol, OMV, ExxonMobil and Suncor as well as oilfield services companies.

Board talk

Shell Ventures expects to make a return on its investments. However, it can play a longer game than most venture capital players and only invests in companies with technologies that have the potential to benefit Shell. Reflecting these priorities, Shell Ventures typically has a seat on each company’s board and assigns a member of its implementation team to help align the offerings with Shell customers’ needs.Peter van Giessel is Shell Ventures’ representative on Rocsole’s board of directors. His role in this capacity is to look after Rocsole’s interests, for example, by scrutinising the company’s scenarios for commercialising and scaling up the deployment of its services and challenging other aspects of its growth strategy. With a dual role as an observer on the board and Shell Ventures’ deployment manager, Michiel van Haersma Buma seeks to protect Shell’s interests while maximising value for Shell, which involves finding applications for Rocsole’s products within Shell’s assets and facilitating their deployment.

What next?

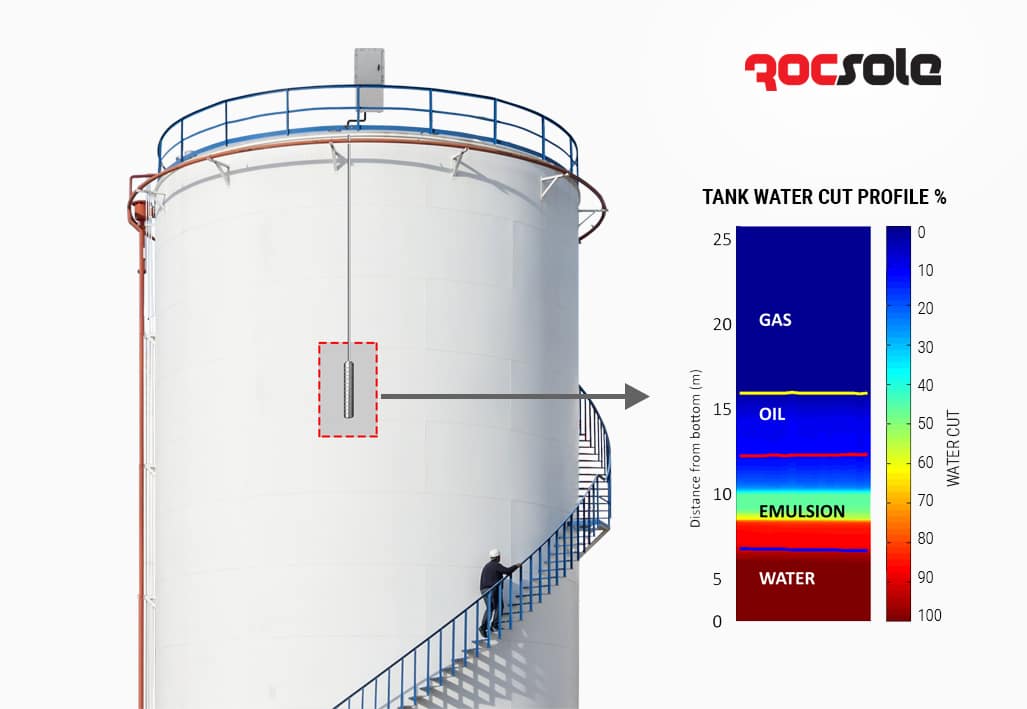

Rocsole already has a variety of applications for its tomography techniques and customises its software for each. Its fixed sensors can reliably identify solid deposits and flow regimes in pipelines and fluid interfaces in tanks, separators and other industrial process facilities under challenging conditions (Figure 2). These solutions are proving to be especially effective in multiphase flows, where the current options in the market often fail.

Mika is very upbeat about the company’s recent achievements. “We have enabled the industry to do continuous real-time monitoring and to see through layers of deposits, which is very difficult,” he says, “and we can do this without using radioactive sources, which eliminates the need to manage significant health and safety issues.”

Figure 2: Rocsole’s Tank Profiler clearly maps the levels, thicknesses and variation over time of water, emulsion and sand layers in storage tanks.

In April, the company shipped a prototype of its Deposition In-Line Inspection (DILI) tool to Brunei, where an opportunity to test it in a real production environment had been identified. The objective of what is expected to be the first deployment of the tool is to validate the measurement technology in a 1-km length of 12-in. underground pipeline where wax deposits are expected. The plan is to run the DILI tool before and after a conventional pig has been used to clean the pipeline.

Although Loek remains involved in the testing and development of the DILI tool, new applications of Rocsole’s sensors and tomographic processing are being explored in a range of oil and gas settings. Potential upstream applications of tomography include using DILI technology modified to run on electric wireline to monitor scale build-up in production well bores; and using a rig-mounted sensor to provide a new way of monitoring the presence of gas in drilling mud. This may significantly contribute to reducing the risk of well blowouts.

In up- and midstream applications, the technology has the potential to detect gas hydrates for flow assurance in flowlines and to scan for the presence of mercury in pipelines. It is also being adapted to determine the level of fluids in upstream electrostatic and downstream refinery desalters.

When used to monitor separators, Rocsole’s sensors and software give valuable insights into the presence of emulsion layers, which are difficult to simulate and model using conventional methods. The company sees great potential for using its techniques in advanced separation solutions. For example, including data from an upstream pipe sensor able to detect incoming slugs can add to the effectiveness of Rocsole’s predictive analytics.

Figure 3: Rocsole’s 12-in. DILI tool being prepared for shipping to Brunei.

Intelligent applications

The company’s short-to-medium-term goal is to derive greater benefits from its solutions by further leveraging its skills in data processing.

With half of its team working on software, coding and algorithms, Rocsole is focusing a significant part of its resources on artificial intelligence (AI) based predictive analytics and deep learning models to speed up data interpretation. The investment is already being rewarded; operations that have typically taken weeks can now be done in a few minutes. The company is also developing an AI system to predict separator performance and enable greater control automation and remote guidance; this is expected to have

compelling value when applied in unmanned production facilities and subsea processing.

The company’s aim now is to train an AI system to forecast how quickly deposits and scale are likely to build up in systems. In the context of what Peter describes as “an ageing industry with less and less money in which it is necessary to squeeze more out of existing assets,” he emphasises the potential of these developments. “Machine learning of trends in continuously acquired datasets has great potential for helping Shell to defer downtime through predictive maintenance.”

Mika is satisfied that the company is now doing well with commercialising its established technologies, but notes that there still are areas where he would value more of Shell’s expertise. Specifically, Rocsole’s use of digital data is very closely aligned with Shell’s ambition to implement machine learning as a core, transformative capability.

“We are very excited about using AI for driving predictive maintenance and are currently building a digital decision-supporting dashboard,” he says, before concluding the interview with an appeal. “Shell Ventures has been a valuable partner on our journey to date. Now Rocsole would really like an opportunity to engage with Shell’s digital transformation team. Perhaps we could find a way to collaborate on testing our new AI system in a pilot project!”